Budget Day - Tax Policy Announcement

Yesterday was budget day and there were a couple of key tax measures announced.

The first was the new “Investment Boost” deduction for new investment assets and the second was an update to Kiwisaver.

Investment Boost

The objective of Investment Boost is to encourage capital investment and raise productivity in New Zealand.

For new investment assets that are depreciable property, the amendments would allow a deduction of 20% of the cost of the asset in the income year the asset is first available for use. New investment assets would include all depreciable property except residential buildings and Fixed Life Intangible Property (FLIP). They would also include improvements to depreciable property and a number of assets that are allowed depreciation-like deductions such as land development costs for farmers.

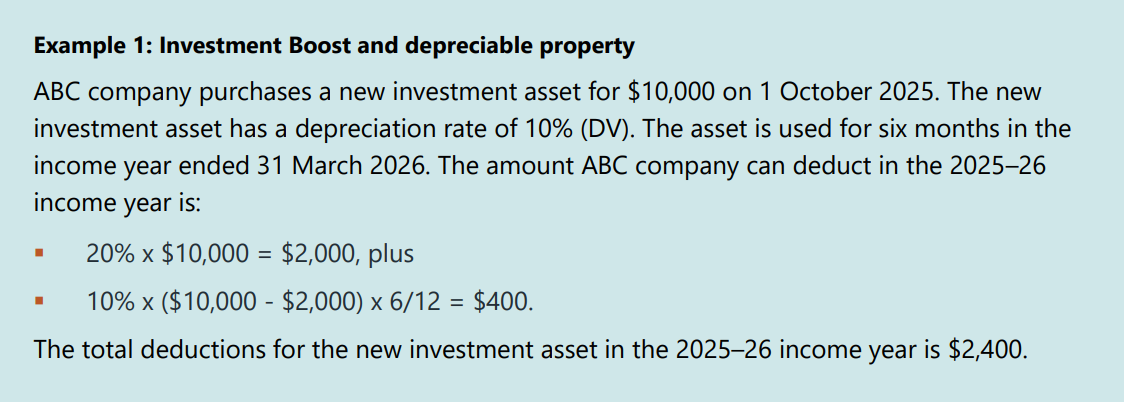

On or after 22 May 2025, the scheme allows assets purchased, or first available for use, a deduction for 20% of the cost in the year of purchase. This is on top of the regular depreciation claim.

The key features of the proposed amendments are:

Businesses would be eligible for a deduction of 20% of the cost of a new investment asset. Any additional depreciation deductions would be quantified as if the cost of the asset were reduced by 20%.

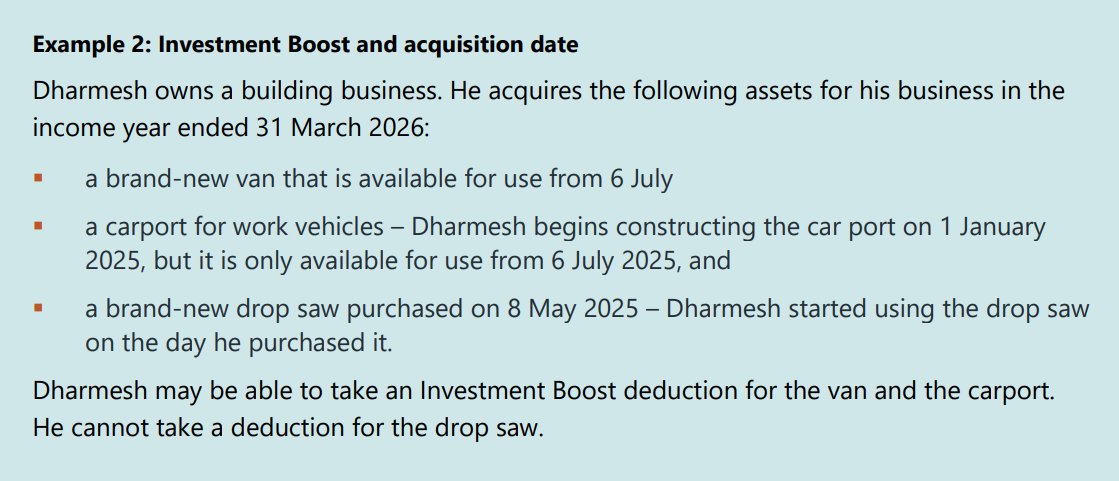

New investment assets that are depreciable property must be used (or available for use) for the first time on or after 22 May 2025. For new investment assets that are not depreciable property, the deduction would only be available for expenditure incurred from 22 May 2025 in acquiring the asset. New investment assets must not have previously been used in New Zealand for any purpose, other than as trading stock.

New investment assets would include:

All depreciable property except residential buildings and FLIP

Improvements to depreciable property (other than to residential buildings and FLIP)

Primary sector land improvements

Assets acquired as petroleum development expenditure and mineral mining development expenditure (except rights, permits or privileges)

New investment assets would include assets (such as certain commercial and industrial buildings) that would otherwise have a depreciation rate of 0%.

The deduction for new investment assets would reduce an asset’s adjusted tax value. Some or all of the deduction may be recoverable if the asset is disposed of (or deemed to be disposed of) and the consideration is more than the asset’s adjusted tax value. Deductions for primary sector land improvements would not be recoverable.

Assets used partly for business could be eligible for Investment Boost, but the deduction would need to be apportioned. A special rule has been developed to support revenue integrity when new investment assets are only partly used for business. This rule would ensure that some of the deduction is clawed back when a mixed-use asset undergoes a significant reduction in business use.

The new policy also excludes secondhand assets that have been used already in NZ. Secondhand assets imported from overseas may still claim the deduction.

Kiwisaver

The amendments propose to increase the rate of employer and employee KiwiSaver contributions.

The matching rate for the KiwiSaver government contribution (or “tax credit”) would be reduced from 50% to 25% up to a new annual maximum of $260.72. Eligibility for the government contribution would be restricted to those with an annual taxable income of $180,000 or less with effect from 1 July 2025 but would also be extended to those aged 16 and 17 years.

Eligibility for compulsory employer contributions would also be extended to those aged 16 and 17 years. The amendments would also introduce the ability for KiwiSaver members to take a temporary rate reduction, which would allow them to continue contributing at a rate of 3% if they wish.

Key dates

From 1 July 2025 the Kiwisaver government contributions will be extended to those aged 16 and 17, the Kiwisaver government contribution will halve to $260.72 from the current $521.4, and the contribution will be restricted to those whose annual taxable income is under $180,000.

From 1 April 2026 compulsory employer contributions will apply to those aged 16-17 and the rate of employee and employer contributions will increase to 3.5% (currently 3%).

From 1 April 2028 the rate of employee and employer contributions will increase to 4%.

You can read the full Bill commentary here: Taxation (Budget Measures) Bill (No 2)

If you have any questions regarding these changes, please get in touch. Your Campbell Tyson advisor will be happy to help.

Cheers

Mat

Mathew Robertson, Managing Director

_

This article contains general information only and based on information available at the date of publication. You should obtain advice for your personal circumstances.